How We Use YNAB (You Need a Budget) on a Monthly Basis

I recently received an email from a reader who was checking out You Need a Budget and was wondering if it was right for him or not? He had a series of very specific questions, which were really good and detailed. And given the fact he had over 35 years experience budgeting, it was clear that there were specific things he wanted his budget to do for him.

Finding the right budget tool that works for you is important, and once you've built the habit of budgeting, you'll want to find the best tools to help you manage your money more effectively, and efficiently.

Disclaimer: You don't need to have sophisticated software, or elaborate spreadsheets to be an effective budgeter. It's more about discipline than it is about the tool. But, if you are looking for a tool that makes budgeting more convenient, and accessible on the go, then I highly recommend YNAB.

We used the same free budget spreadsheet that you can get when you sign up for the newsletter on this site when we were getting started. It worked great for us and helped us develop the budgeting skills we needed to pay off $40,000 of debt in 23 months. So, again... not about what tool you use, but YNAB does make the budgeting process easier for us on a monthly basis.

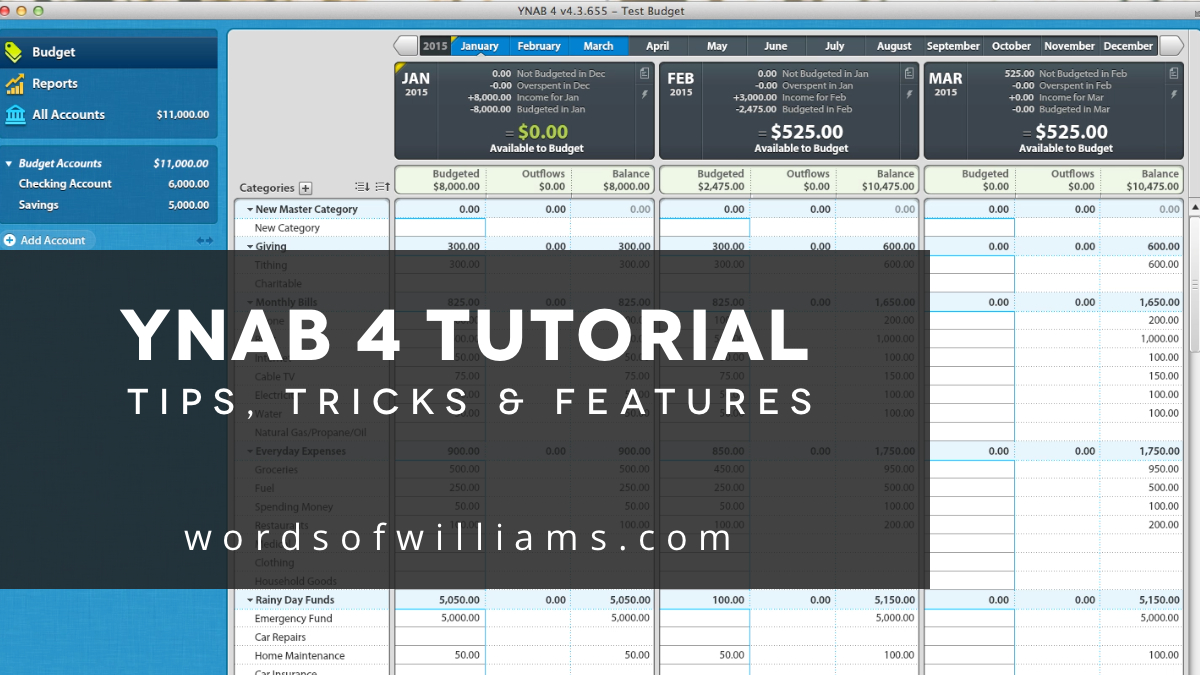

So, let's look at all the ways YNAB does make it easier for us. And I thought the best way to do that, would be to give you a guided tour of how we use YNAB on a monthly, weekly, and daily basis.

How We Use YNAB on a Monthly Basis

Let's start with the big picture... putting together the initial budget before the month begins. As with budgeting in general, the first one is always the hardest. Determining categories and thinking ahead to all the expenses that might come up that month, not to mention saving for particular categories in the future. (Hello Christmas, car repairs, and those annoying non-monthly bills)

For these reasons, the set up of a budget is just as difficult in YNAB as it is with your first budget on paper, or in a spreadsheet.

Enough of the bad news! Let's get down to setting the budget for the month. For us, I typically set the budget first, then ask Kelsey to review it and make initial changes if she doesn't agree with something.

Our budget is typically pretty static from month to month. We try to eliminate chaos in our budget by breaking down savings for things into small monthly goals and that keeps us from having to shift a lot of things around in our budget.

Built-in Budget Savings

This is our favorite feature in YNAB. Each category acts as it's own savings account, and the money we do and don't spend (transactions) from that category carries forward to the following month. We don't have to worry about transferring the money, or keeping track of how much we've saved and spent from our personal accounts every month.

We simply log the transactions as we go (I'll talk about this more in the daily section) and YNAB does the rest.

Scheduled Transactions in YNAB

Setting up Scheduled Transactions is super helpful in automating our budget process. First, you'll want to set up auto-payments for your bills through your bank account, or billing service (gas, electric, water, cell phone, internet, insurance, cable just cancel cable).

All the things that get auto-drafted from your bank account on a monthly basis can be set as a scheduled transaction in YNAB to come out in the appropriate timeframe on the appropriate date. (see screenshot)

This saves from having to manually log those transactions every month. It makes the budgeting process simpler and allows us to then focus on our discretionary spending... a.k.a. the stuff that makes your money disappear.

Mid-Month Management of YNAB

On a bi-weekly basis, I try (not perfectly) to clear our transactions and reconcile our transactions with our accounts online. I'm not overly nerdy about this, but it accomplishes the following:

- Ensuring we entered numbers correctly (it can be easy to transpose numbers... I have giant hands)

- Double checking if we missed anything (like a second sweep of the hotel room before you leave)

- Flagging any suspicious activity (My debit card number has been compromised twice in the last year, both caught by my bank)

We also pull out cash from the ATM every week or so for groceries, and eating out. The process is pretty simple.

- Pull money from ATM

- Log the transaction with the YNAB mobile app as an expense to our food category.

During the month we also make adjustments as needed. For example, we keep a category called "payback" for things that we're waiting to be reimbursed for. Kelsey wrote a check to a friend to make some monster cookies when Kelsey told her co-workers she was pregnant. A few others went in on it with her and we were waiting to be reimbursed. So, when that check comes in, we designate it toward the "payback" category so we know everything is squared away.

If something unexpected comes up, we talk about it and try to see what categories we can borrow from to make the budget balance. -$20 from our fuel category, because we don't need as much (hallelujah!), and apply it toward toiletries, because we didn't account for the fact that we would run out of laundry detergent this month and it's a bigger cost than our toiletries budget allowed for.

I call this active budgeting. As much as we want to set our budget and watch it perfectly unfold throughout the month, that's as mythical as a unicorn. Life is too dynamic for it to be that way. We had to embrace this early on and it saved us a lot of frustration when it came to our sticking to a budget.

Daily Tracking / Logging Transactions in YNAB

The magic behind YNAB in comparison to our budget spreadsheet is the cloud sync technology. It's connected to our DropBox account, and is synced between all of our devices (computers, iPhones and iPad although Rooney has a Monopoly on that last one).

We can access our budget from anywhere, and can log transactions often before we leave the checkout counter. My favorite part of this is how YNAB gets smarter the more often you use it. Here's a short video of Kelsey live at one of her favorite stores... H&M.

[tentblogger-youtube lIQ4UMzrdC0]

When I'm pumping gas, and log the transaction, all I have to do is input the total amount, and YNAB knows where I am and what category I usually plug that expense into. YNAB auto-populates "Gas Station X" as the Payee and "Fuel" for the category. Approve the transaction and BOOM, you're done.

So, that's how we use YNAB on a monthly basis. I also put together a video tutorial walking through the software and the features we use and love. It's eight minutes long, but if you're interested in how we use it to keep up with our budget I think it's worth the watch before making the investment in the software.

[tentblogger-youtube 5vOsZH0v1-8]

A Few Other Things About YNAB

- You can get 10% off by using my affiliate link before purchasing. (In full disclosure, I'll get a kick-back as well)

- My initial review of the software when we first started using it.

- YNAB Rule 1: Give Every Dollar a Job

- YNAB Rule 2: Save for a Rainy Day

- YNAB Rule 3: Roll With The Punches

- YNAB Rule 4: Live on Last Month's Income

If you already use YNAB, what are your favorite features or tips?