YNAB Budgeting Rule #4: Live on Last Month's Income

The last, and possibly the best (in my opinion), of the four YNAB rules is "Live on last month's income." It may take some time, but when you get there, it will be monumental to making budgeting easier. When we started budgeting we were working at the same company and getting paid on the same day (every other Thursday). When we put together our budget each month, we were anticipating that money coming in (projection). This works pretty well for anyone who is salaried or whose income does not fluctuate from month to month.

However, we were still projecting what our income would be for the month and then making small adjustments throughout the month if our actual income was higher or lower. We were also having to time our bills to our paychecks to ensure that we had the money allocated at the right time of the month so that nothing slipped through the cracks (stressful).

By the way, this is how Dave Ramsey taught us to budget, and it's certainly not wrong. It worked for us for years as we paid off debt and built up our emergency fund. It's not a bad method, and, in fact, it's how our budget spreadsheet is set up (again, we budget this way for years).

When we discovered YNAB and started thinking through their rules and compared them to what we knew to be true of what worked for us, they all made perfect sense: give every dollar a job, save for a rainy day, roll with the punches... yeah, yeah, yeah, budgeting basics and the foundations for sound personal finance. And then it hit me...

Rule #4 - Live on Last Month's Income

Beautiful. I'll explain in a minute how you can get there if you are not quite as far along in your financial journey, but for now this is where we were at when discovering "live on last month's income."

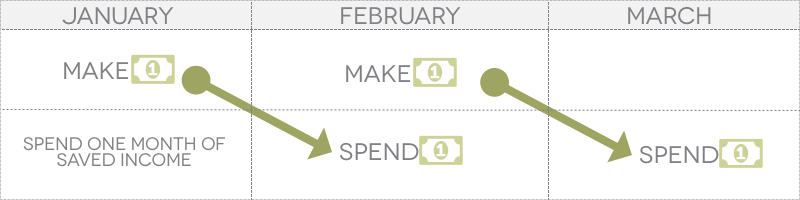

We had all of our debts paid off and six months of expenses in our emergency fund. This rule was a no-brainer for us to implement. We simply took one of our six months of expenses to cover our expenses for the current month and then started applying our current month's income toward the next month's budget.

And the YNAB software makes this a piece of cake. When you enter a transaction, it gives you the option to apply the income to this month or the next month. They've optimized their software toward their rules and makes it pretty seamless. Of course, you can do this with a budget spreadsheet as well, you just have to do it manually.

And that brings me to the peace that living on last month's income brought to us.

- No more timing of bills: We no longer have to worry about our paycheck coming on the 2nd of the month needed to cover the bills due on the 1st. The money is already there.

- Less monthly budget maintenance: Because all of the income needed for the entire month is available at the beginning of the month, and all of our bills are auto-debited from our account, we don't have to worry throughout the month about bills being covered.

- Security: If something happened (an event that would require us to use our emergency fund), we at least know that the current month is taken care of. It allows us to focus on planning how to handle the emergency and worry about next month's budget later.

- Peace of mind: It's a great feeling to not have the stress of all the weekly budgeting madness, timing bills and expenses to individual paychecks.

How You Can Apply Rule 4 - Live on Last Month's Income

If you are just getting started in getting a handle on your personal finances, you may think you're not able to apply this rule now. I've been thinking about that, and I think this rule can be applied early on in your budgeting journey if you want to.

First, I suggest you have a good handle on your budget and a good monthly flow and understanding of where your money comes from and where it goes.

Next, you'll just need to save up one month of expenses to get you started. Then simply apply that savings to the current month and then start saving the income you receive this month to next month on your budget.

This should work well if you have fluctuating income. Of course, when you have really good months you'll want to save up for the not-so-good months, but it will at least keep you a month ahead of the curve.

I see this meshing well with Dave Ramsey's first rule of the $1,000 emergency fund. Perhaps save that and one month of expenses to apply YNAB's Rule Four before tackling your debt. It may delay your debt payoff a few months, but the peace of mind through the journey might be worth it.

Have you ever thought to live on last month's income?