How to Make a Budget for the First Time

We have been budgeting for three years now. It's not a long time in the grand scheme of things, but long enough to know that the first one is harder than all the rest combined. It's challenging to account for everything that will happen between paychecks. Life is full of surprises, and it's better to have a plan of attack than to let them run you over.

I'm not a budgeting expert, and I don't have a super complex formula to squeeze millions of dollars from your paycheck. But, we do have three years of experience that we will share with you to get you started on a budget.

How to Make a Budget for the First Time

- Gather all of your financial data. The main point of budgeting is to get a handle on all of the expenses that you have in a month, and to make a plan for every single dollar before you get it in your bank account. This might require that you go through your bank statement to figure out how much each bill costs, when it is due and to get a rough estimate for how much you spend in each category (housing, gas, food, entertainment, clothing, toiletries, etc.).

- Start with an open mind. Attitude is everything. We were an emotional wreck when we sat down to do our first budget. We didn't get it, and it was frustrating. Keep your chin up. It gets better. After the first one, the rest are pretty simple.

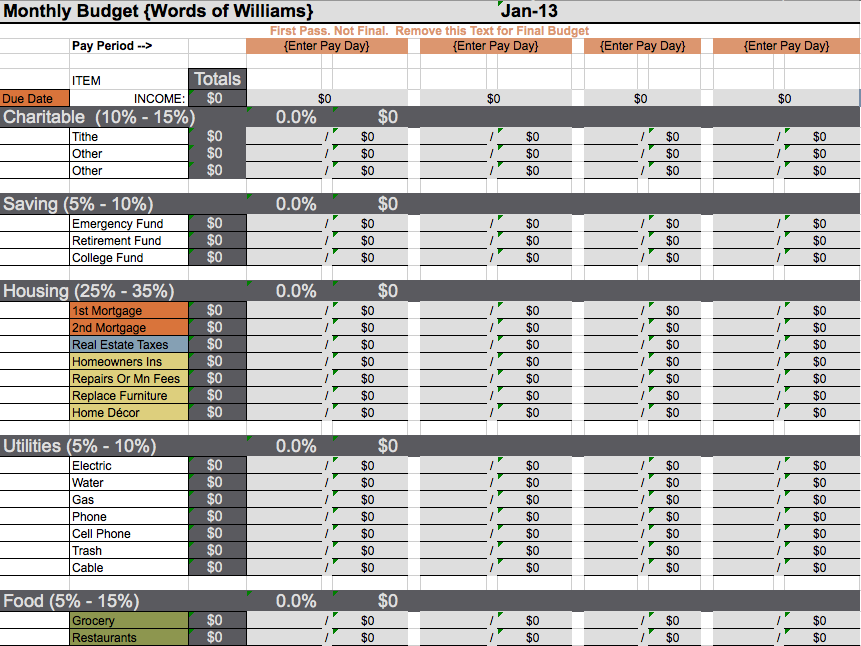

- Use the tool that works best for you. We tried to do our first budget on paper. It was horrible. There was so much eraser dust. We quickly found comfort in an electronic budget spreadsheet template made by our mentors in our Financial Peace University class, which we now available when you sign up for our newsletter. This changed budgeting for us forever! We love it. You may not. A written plan might work better for you. Find what works best and run with it. Here's a look at the spreadsheet we use:

- Allow yourself enough time. It took us about four hours the first time. Again, we didn't have the best tool at that time, but don't sell yourself short. This is something you will be using for a long time. Give it the time it deserves. Don't try to cram it into a 20-minute window you have.

How to Keep a Budget Going

- Review it often. We look at our budget almost daily. This might make you cringe, but we don't keep a checkbook register. We're all digital, baby! This is why having the right tool is so important. It must be easy for you to access and easy to change and reference.

- Record every transaction. The amounts we enter on our budget are estimates (except for some bills that are the same every month). At least once weekly we compare our budget spreadsheet with our online banking service to make sure we didn't miss anything and to record the final amounts that were paid. You might choose to keep your receipts until they are logged into the spreadsheet. We bold the final amount once it is paid so we can tell at a glance how we're doing.

- Get an accountability partner. Every situation is different, but hopefully your spouse is on board if you have one. If you don't, ask a trusted friend to help you stay on track with the important financial decisions. I would not be able to stay on track if it weren't for Kelsey keeping me honest, and vice versa.

- Plan ahead. On the budget spreadsheet we use, there is a category called blow. This is a catch-all or padding. Because we have gotten better and better at anticipating expenses (which comes with experience), we only allow $20 per paycheck in that category. Each month we look ahead at what we have planned (gas for travel, dinners out with friends, etc.) and budget accordingly. This is key to making your budget as close to accurate as possible. We have to make adjustments on the fly, but they are usually minimal.

Other Tips

- Set up budget billing. We have budget billing for our gas, electric and water bills. They take a 12-month total and we pay the average of that for the following year. This takes a lot of fluctuation out of our monthly bills. These bills adjust slightly every year depending on usage, but the peace of mind it brings us is awesome!

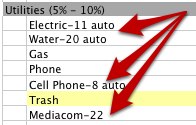

- Set up automatic payments. We were hesitant to do this at first, but it's so easy to do, and we don't have to worry about remembering to pay our bills and what day they are due. This is especially helpful now that we have electronic statements for most of our bills.

- Note when bills need to be paid on your budget. On our budget spreadsheet, we note next to the mortgage category that the bill is

due on the 1st. Next to our water bill, we note the date it's due as well (20). This helps us plan which paycheck that budget item will have to come out of, since we get paid every two weeks and not on the same day every month.

due on the 1st. Next to our water bill, we note the date it's due as well (20). This helps us plan which paycheck that budget item will have to come out of, since we get paid every two weeks and not on the same day every month. - Use cash. We use cash for two categories: food and hair care (the two things we tip for). We know people who use cash for more items, but this works for us. We have an envelope for each cash category. You may want to use cash for more or less; the point is that you take control of your spending habits and only spend what you have written/typed on your budget. Going over your budget means you spent more than you made.

What frustrates you most about budgeting? What tips do you have for others?