Budget Breakdown

One of Kelsey's Snappy Casual readers asked what our budget looks like when she posted about having $10/week for clothing (plus bonus opportunities). While we don't feel comfortable sharing the exact numbers of how much income we have, we do think it's important to keep an eye on the percentages that you allow for each category in your budget. We will share with you what financial experts say it should be, what our percentage breakdown is and a few thoughts about it along the way. Our budget spreadsheet has the percentages built-in to help you keep track. Here's a look at the recommend and what our current percentages stand.

Recommended Percentages (Our Percentages)

Charitable Gifts: 10-15% (13.1%) Saving: 5-10% (12.1%) Housing: 25-35% (34.7%) Utilities: 5-10% (7.1%) Food: 5-15% (8.1%) Transportation: 10-15% (8.2%) Clothing: 2-7% (3.2%) Medical/Health: 5-10% (0%) ** Personal: 5-10% (7.1%) Recreation: 5-10% (6.3%) Debts: 5-10% (0%)

**Our health insurance comes right out of our paycheck so we don't budget anything for this from our paycheck. We also have a flex account that we can use for co-payments and other medical expenses which also comes out of our paycheck.

Reflections on Percentages:

- We don't look at these breakdowns enough, but we should. As I write this, I have a fresh perspective of where we spend our money. Besides our house that we are trying to sell, I am pleased with how we allocate our money. Looking at our percentage breakdowns affirms that we are on track with our overall goals for the finances in our lives.

- I often beat myself up (figuratively, of course) by thinking that we don't give enough money away and that we don't save enough money. It humbled me to see the numbers written out above.

- Transportation is low because we don't have any car payments. That sure is nice, and serves as a good reminder that car loans suck. I hope we never have one again.

- Seeing our debt percentage has the same effect. One of two categories we are out of the percentage range is savings, and we are on the high end. The 12.1% that we are saving now was all going toward paying off our consumer debt before we became debt-free.

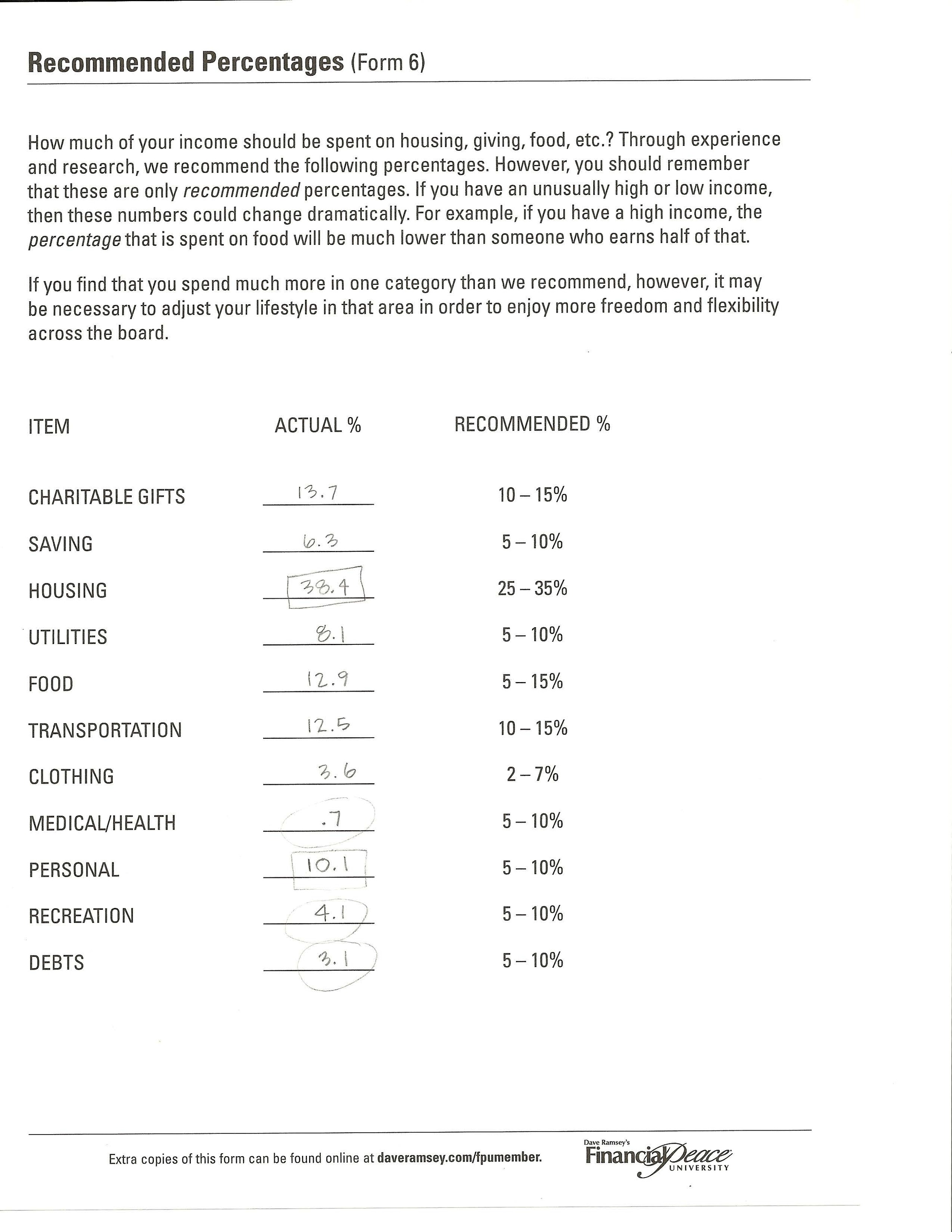

I thought it would be fun to look back at the first time we did a percentage breakdown. So, I dug out our worksheet from Financial Peace. This was done the night after we learned what a budget was, so we had not yet practiced anything that Dave Ramsey had taught us yet.

Notice anything?

The percentages add up to 113.5%! That's horrifying. We are so glad that we took the class when we did, because we were digging a bigger and bigger hole for ourselves each month. Which leads to a very good financial and life lesson: Sometimes when we are so focused on what is going on in the short-term, we forget to step back and realize how far we have actually come.

This was a fun post for me to reflect on, as I get discouraged without seeing immediate results on a daily basis. But, when I look at how far we have come over the last 2.5 years, it makes my heart smile.

Are there areas of your budget that are off-kilter and need realigning? We'd love to hear your thoughts.