So Many Budgeting Tools: How to Choose the Right One?

There are a swarm of different budgeting tools available on the market today. Lots and lots of them. Probably too many to choose from, right? Deciding which one is right for you can leave you stuck giving up on budgeting all together. Fear not! Let me give you some ground rules for choosing a budgeting tool that will help you get control of your finances.

When choosing the right budgeting tool, you'll certainly want to spend some time figuring out all of the benefits and features that each offers, but what you don't want to do, is NOT choose one at all. It's better to choose one and use it, than to not be on a budget.

The Basics You'll Need for Your Budget

The features that come with most budgeting platforms aren't really necessary for the basic functions of budgeting. Budgeting is simple in that you are proactively telling your money where you want it to go, and then following the plan you've set up.

After it's set, it's simply a matter of executing the plan, or going back and moving things around. Much like a calendar, sometimes you have to move your appointments around.

- Forecasting: A budget must be forward thinking. It must allow you to declare where the income will go before it's actually spent. If it only shows where the money was spent, it's just an expense tracker.

- Saving: The budget platform should help keep track of categories that carry-over from month to month to build up savings in particular areas of your budget.

- Mobile: At bare minimum the budget should be accessible to view while on the go. I'm not so concerned with being able to change it on the go, but being able to pull up the numbers to see if you have enough to make a purchase helps when trying to change behavior.

A Few Budgeting Tool Options for... Every Budget

I've said it before, and I'll say it again; the best budgeting tool is the one you will actually use. Keep that in mind if you're in the market or just getting started looking for a budgeting tool.

Free Budgeting Tools

It's always great to save money where there's money to be saved, but sometimes you also get what you pay for. I think that's the case with some free budgeting tools. They will certainly do the trick, but might take a little more effort.

We used a budget spreadsheet (same one as below) and were able to pay off all our debt (except the house) and save up a six month emergency fund. So, I know it works, first hand, but I also know it took a little more effort. But, it might be worth it to have a more hands-on budget tool for the first few months to help you understand all the ins and outs of your cash flow.

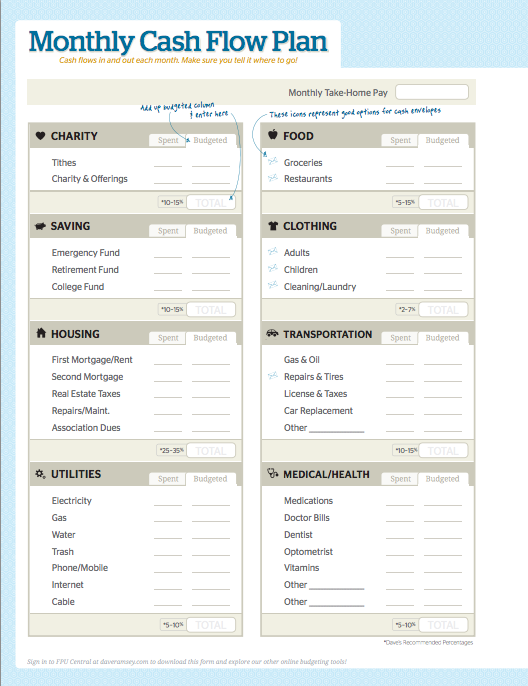

Monthly Cash Flow Plan

- Platform: PDF/Paper (like...get our your pencil and bring a big eraser)

- Forecasting: Yes. You fill out the paper budget before the month begins and then follow it.

- Saving: No. If you have leftover money from your paper budget, the PDF kind of leaves you hanging. You'll need to find a place to keep track of your savings categories such as gifts, vacations, Christmas, etc.

- Mobile: Not really. You would have to carry around some sheets of paper with you at all times. Not the reliable way to stick to a budget. (Unless of course you carry a trapper keeper with you, then just put your cash flow plan in your trapper keeper.)

While very simplistic, the paper budget still works for some people. It keeps things very straight-forward and can really help you understand the process of budgeting. Good for those who work best when they physically write things down.

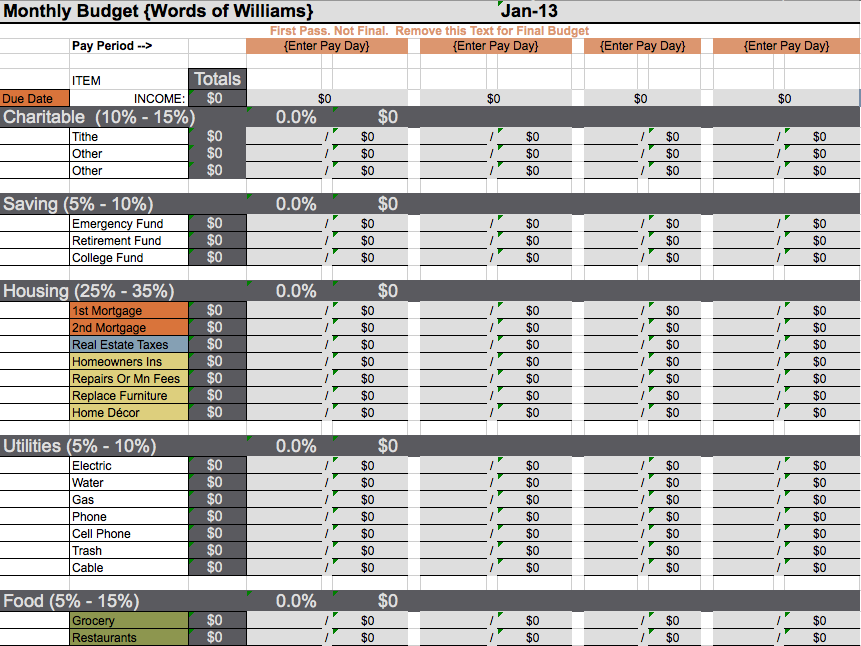

Budget Spreadsheet

- Platform: Microsoft Excel

- Forecasting: This is essentially the monthly cash flow plan in electronic version. It's based on the same principles as the paper version, with a little more flexibility and guidance on how to use it.

- Saving: Yes. The spreadsheet has a separate sheet for building up your savings categories as the months roll by. It takes minimal Excel knowledge to work the spreadsheet and keep track of your savings.

- Mobile: If you save the budget spreadsheet in the cloud using a service like DropBox, you can at least view the spreadsheet on the go. That's what we did back in the day (like a year ago...). It'll keep you honest when you're out and about and thinking of purchasing something, but not sure what you had budgeted.

This is the spreadsheet that got us out of debt as mentioned above. Very effective with a bit of work to maintain and keep up to date. See this post for a full written and video tutorial.

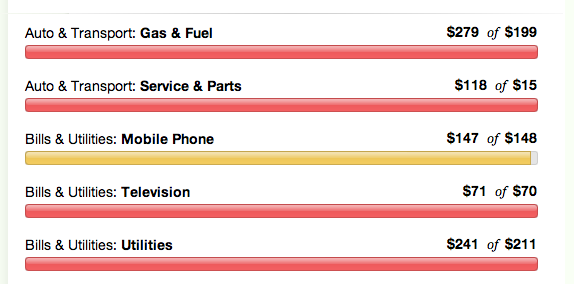

Mint

- Platform: Web-based

- Forecasting: Mint does have forecasting built into it, however, I find it kind of dis-jointed. It doesn't make for easy adjustments, but does allow forecasting. The plus side is that it is also tracks your expenses at the same time so if you've been using Mint for awhile, it will help you create your first budget by quickly showing you what you've spent historically in each category.

- Saving: Mint allows you to create savings goals to keep track of your progress. By linking your goals to categories Mint will keep track of the savings categories for you.

- Mobile: Yes. Smartphone apps will keep you plugged in while on the go.

Mint is probably the most popular among web-based money tracking sites. The one downfall is that they try to offer you financial services you may not need/want. Here's how we've used Mint in the past.

Budgeting Tools That Cost Money

Sometimes it's worth paying for something that is extremely useful. It might save you time, headaches, or frustrations for you in the future. And that might be totally worth it to you. Again, we used a free spreadsheet for about three years before we even looked for different budgeting solution.

And while I didn't actually pay for what we use now (YNAB), (well, if you don't count spending countless hours blogging to the point where a company would offer you something for free), I'll say that I would have paid for the convenience and time it saves.

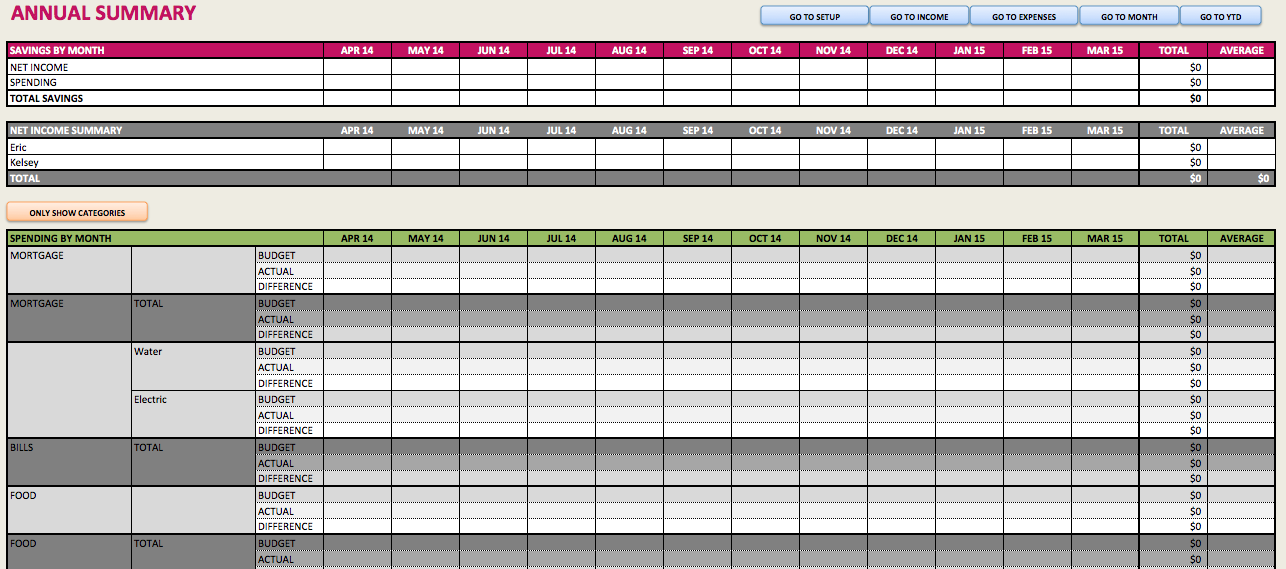

Super Deluxe Budget Template by Savvy Spreadsheets

- Platform: Microsoft Excel

- Forecasting: Yes. The super deluxe budget template is made to forecast your dollars, and being built in Excel keep it away from being tied to your bank account and prevents it from being an expense tracker. Although, it does have reporting built in so as times goes on you can see how you've spent in certain categories.

- Saving: Yes. The spreadsheet has built-in savings within each category.

- Mobile: You'll need to save the spreadsheet in the cloud so you can view it o the go.

- Cost: $15

For the cost, you'll get an excel spreadsheet that will blow your mind. It's pretty much a fully functioning budget application inside of excel. Really cool tool with great value, at a low cost.

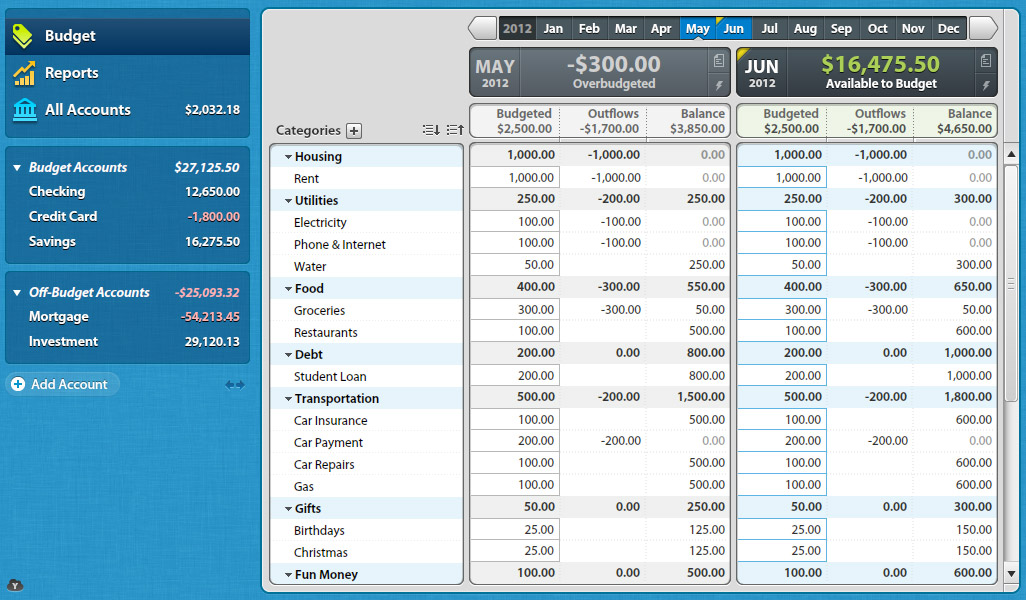

You Need a Budget (YNAB)

- Platform: Computer Application/Software

- Forecasting: Yes. YNAB will show what you have available to budget for the month, and rule number four suggests that you live on last month's income, which takes forecasting to a whole new level and helps to stop living paycheck to paycheck.

- Saving: Yes. The category account balances carryover from month to month and works as built in savings. If you don't spend out of a particular category, the amount budgeted just stays in there.

- Mobile: Yes. Their mobile app (iOS anyway) is fantastic for logging transactions on the go. it's got a great built in memory for where you've been. When you are at the gas station, it knows your location and will predict that you want that money to come from the fuel category. So slick.

- Cost:

$60$54 (affiliate link)

You can read about YNAB's rules 1, 2, 3, and 4 and also the full review. YNAB is the budgeting software that we use and love! But, again, everyone is going to have different preferences when it comes to budgeting tools. YNAB does offer a free 34 day free trial if you want to test drive it.

That's a lot of options to get you started with budgeting. Give one or two of them a try and see what you think. Move onto another one if it's not making sense after a few months. Just keep trying until you find something that works.

What budgeting tools have you tried in the past? What works for you? What hasn't worked?