7 Ideas to Crush Your Debt

You’ve lived with debt for as long as you can remember. It’s burdened you for far too long. You’re ready to crush it once and for all and move on with your life. But, now what? How do you translate that desire into a plan that you can execute? You’ll have to come up with a strategy that works for you. Because, without a solid plan, your motivation will fade and you won’t make it over the top of the hill.

7 things to think about when creating a debt snowball plan.

1. The Details

List them out, know them, track them, keep them top of mind, know where you start. Writing things down matters. And having a way to update your debt snowball and one place to keep track of where everything is at all times is crucial to watching your debt vanish. There are plenty of tools out there to help you, but I still really like this spreadsheet from vertex42.com. It’s flexible, and in case you decide you want to switch up the order of your debt pay down, it can do that too. And at the bottom, it always shows you when your debt will be gone if you stay on track. Update it monthly for best results.

2. Extra Goal: Minimums Plus What?

In order to figure out how long it will take to pay off your debt, you’ll need to come up with some sort of ballpark figure of how much extra money you’re wanting to put toward your debt on a monthly basis. This would be the dollar amount above and beyond your minimum payments. That extra money is what will drive down your debt faster. It’s the turbo boosters that propel you past the interest that’s accruing and gets your snowball rolling quickly down hill. You can do that through the following ways...

3. Extra Job

Look, I know that getting an extra job might not be fun. If you have a family, definitely not fun, but the best advice I have if you are looking at working extra is that you have a plan. Having a plan for how long your debt is going to take to get paid off, will help keep you motivated during those long days of working long hours. I did this for about 15 months while we plowed through our debt snowball. We didn’t have kids at the time, but it was still stressful on our marriage and I just couldn’t wait to be done with that second job. But, it also kept me focused, kept me from spending money and helped us get through our debt that much quicker. Again, this is only for a period of time, which is why it’s so important to have a goal and have a “I’ll quit, when...” strategy. For me, it was as soon as our last debt payment was going to be made, I quit.

4. New Job

If there are opportunities for you to get a promotion, perhaps this is a better route for you. Poor your efforts into advancing your career. If this is an option for you, it’s likely a better long-term solution than spending your time and energy getting a lower paying part-time job. If you can work toward a promotion and use that pay increase to help pay down debt, then do that. But, I would say if that’s more than three months out on the horizon, then look for something in the short term to bump your snowball dollars as well.

5. Pausing or Pinching Important Things

Once you have a plan, it can be accelerated by temporarily squeezing. I say temporarily because again, I don’t want you to think that this will be how you must live forever. If you make a change to your lifestyle or pause your retirement contributions for a short-time to speed up your debt paydown, then you better have a plan to start it up again at a certain date. I would suggest writing that into your plan so that those extra dollars don’t get sucked into lifestyle when the debt is gone. It’s OK to pause temporarily, but turning off retirement contributions long-term can have extreme consequences 30 plus years down the road.

6. Sales Job

Selling things around home, or flipping your car situation are good ways to create and influx in cash. We recently decided to off-load some items from around our house (a lot of baby stuff we were done with and some other home stuff we weren’t needing or using). We were able to make over $200 by taking pictures and posting the items for sale on Facebook. I’ve never hosted a garage sale, but this seemed easier and more effective. And then we donated the rest of the stuff we didn’t think was worth selling. The thing with selling things after years of accumulating is that it can be addicting. It also helps you shift from a consumptive mentality to a cash mentality. The cash becomes more valuable because you are using it toward your goal. It’s some extra ooomph needed to pay down your debt faster.

7. Celebrations

You can’t go crazy, but you can make debt payoff fun. Set up a little reward system for yourself that will keep you motivated along the way. What’s something you can do for $20 every time you pay off a debt? Go out to eat, or buy some ice cream, use the dollars and the time to reflect on the payoff and gear up for the next one. Pause and then keep moving forward. It’s like taking a break between sets at the gym. Catch your breath before getting back to work.

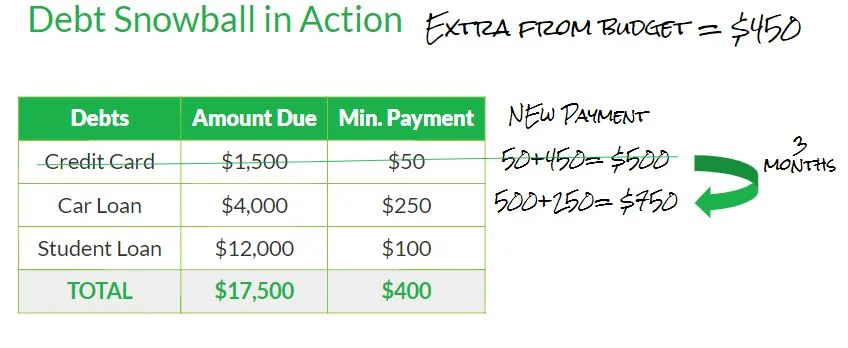

Simple Example of a Plan to Payoff Debt

I used this example at a presentation I gave a few months ago. It’s simple math, but putting a timeline to your debt and some hard numbers to a debt snowball can be a powerful illustration for motivation. Your numbers might be different, but I hope that you can see how valuable writing this stuff down can be.

Credit Card Debt:

- $1,500 total

- $50 minimum payment

Car Loan:

- $4,000 total

- $250 minimum payment

Student Loan:

- $12,000 total

- $100 minimum payment

Extra Cashflow per month after working the seven steps described above: $450 per month

Now as we look at focusing on the credit card debt first, we add the $450 extra to the $50 minimum payment we are already making and now we are paying $500 per month toward the credit card and paying it off in three months.

Now, to get the snowball rolling! Take the $500 we were making toward the credit card and roll that right into the car loan: $500 + $250 = $750 total going toward the car loan.

Five months after the credit card is paid off the car loan is paid off... and we keep it rolling!

Once the car loan is paid off, roll the $750 + $100 minimum payment you've been making on your student loan and now you're plowing through your final debt at the speed of $850 per month. In just over a year (13 months) the student loan is paid off.

As the debt snowball picks up steam, if you stick to the plan, you'll be debt free in 21 months.